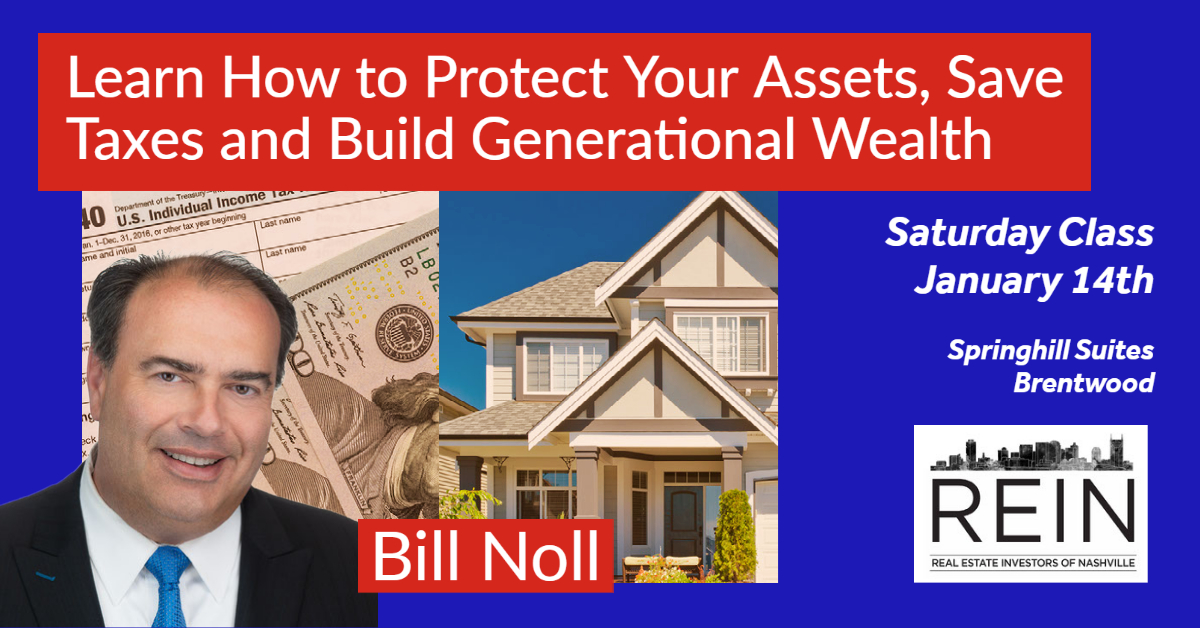

Attorney/CPA Bill Noll Will Teach You How Families Build Generational Wealth in Real Estate

Meet our January Guest, Bill Noll. Bill is a lawyer and CPA at Noll and Company CPA’s, and also operates a separate law practice focused on tax compliance and tax-related litigation. Start off 2023 right with this all day, information packed, worth every penny, in person course.

- Learn more about how to properly structure an LLC for Real Estate.

- When to use multiple LLCs and when just one LLC better

- Learn About Dynamic Tax Strategies for Real Estate Investors

- Learn how the Internal Revenue Tax Code provides special benefits which are only available to real estate investors

- Learn little understood strategies for maximizing depreciation deductions and when repairs can be deducted all in one year

- Why you MUST avoid reporting sales transactions as a dealer

- Here About How Your Real Estate Can Be Sold Tax Free

- Learn How to make all of the Equity in your Real Estate Disappear From Public Records

What else is on the agenda for this full packed day?

• How to use the LLC & Trust Asset Protection System

• A complete system for the formation, organization and operation of an LLC in all states without expensive lawyers

• How to have ironclad protection of your personal assets and valuables

• How to save substantial amounts of taxes every year

• How to defend yourself against IRS attacks

• How to prevent legal disputes and save thousands in legal fees

• How to successfully operate your real estate business

• How to legally and safely deduct real estate education expenses

• How to use commonly overlooked tax deductions

• How to sell properties tax-free via 1031 Exchange

• And much, much more!

• Finally, the Total Solution for Total Protection for all of your assets, personal and business, without adverse tax consequences, without IRS audits risk, without over complexity, and without costing a fortune!

• Why an LLC for every property is not only expensive, but still does not totally protect you. You will learn a much better, easier and more affordable strategy that you will love!

• Learn about the Insurance Myth – 13 liabilities that insurance does not cover which could lead to an expensive legal action. How to protect your family against these dangerous liabilities.

• How a properly structured LLC still protects your personal assets, even if you manage your own properties. This will blow your mind!

• Learn the truth about Nevada Corporations and which state is best for forming an LLC.

• Why TV and Radio promotions for sites like Legal Zoom may not be the best solution for your entity structuring.

• Get access to the most effective legal documents, empowering your LLC to be an impenetrable fortress of asset protection!

• How to avoid the costly, irreversible disasters of not having your LLC set up properly.

• Why wholesalers can be prone to legal actions as much as landlords and how to avoid this.

• How your LLC can fully and safely deduct education and other startup expenses, even if you have never done a deal yet or already setup your LLC!

• PRIVACY POWER – How to be off the public records in any state when setting up your LLC.

• Why you must avoid other entities (including S-corps) that are a tax disaster and an IRS audit trap.

• Find out more about “Offshore” accounts.

• How to audit-proof your returns against costly, time-consuming, aggravating IRS audits

• Use the miracle of “Componentizing” to triple your depreciation deductions with no cash outlay to create paper loss deductions and dramatically increasing your tax-free cash flow.

• Fully deduct these paper losses against your other income with no limit, regardless of the paper loss amount, regardless of your income, even if you have a full time job…without IRS audit flags.

• How to retroactively save on overlooked deductions that can save you thousands of found money.

• How to totally avoid the costly consequences of being a dealer, even with a large number of flips.

• Show to sell your properties tax-free and keep all of your profits.

• How to avoid inept CPA’s who cost you more than the IRS!

• Have access to the best real estate CPA’s in the country.

• How to get a free tax-return review for the potential of getting back refunds of past paid taxes. It’s like free government money, you can use to invest for more money!

• Real world case studies and much, much more!